The website Unusual Whales follows the portfolios of their Congress members while they trade. You should click on that link as they do a phenomenal job and produce a chart that looks at how each trading member did at the end of each year. As usual, Congress blew the market out of the water when compared with the SPY*.

Members of Congress are required to disclose their personal finances through financial disclosure procedures. Financial disclosure forms are filed annually and every time they or their families make a trade. These forms are made available to the public through the Office of the Clerk of the House of Representatives and the Office of the Secretary of the Senate. These forms are a key tool for promoting ethical conduct in Congress and are an important part of efforts to promote integrity and transparency in the legislative process.

Top buys for House Republicans included ConocoPhillips (COP), Tyson Foods Inc (TSN), Alphabet (GOOGL) and NGL Energy Partners (NGL). While House Democrats bought up tech stocks such as Apple (AAPL), Microsoft (MSFT) and Alphabet too.

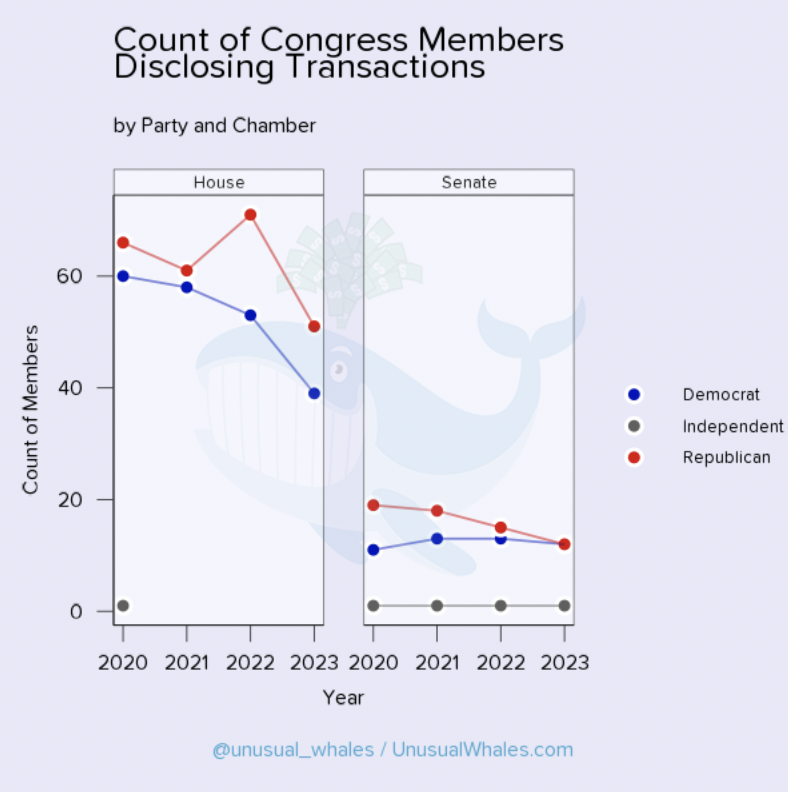

Note that there are a total of 535 Members of Congress, with 100 in the Senate and 435 in the House. So in 2023, only a fifth of Congress members were trading, which was down from approximately one-third (2020-2022).

A contributing factor was the defeat/retirement of prolific stock traders from years past, such as Alan Lowenthal (572 stock trades from 2020-2022), Jim Langevin (93), Cindy Axne (138), Marie Newman (205), Kurt Schrader (330), Thomas Suozzi (336; and running again!), Chris Jacobs (263), David McKinley (144) and Trey Hollingsworth (69).

However, the current congressional class has some standout newcomers that have disclosed more stock trades than legislative votes.

TL;DR

- Congress beat the market, once again. Of 100 trading members, 33% beat SPY with their portfolios.

- Democrats beat their Republican colleagues by a massive margin.

- Members are once again trading options, after not trading them in 2022.

- The overall number of transactions by Congress is down. They are also reducing time to disclosure, as well as using the note feature, because people now watch them vigorously.

- There were many unusual trades and conflicts

- If you are a member of Congress or aide reading this report, are embarrassed or want to work with us or fight for market transparency, we can be reached at congress@unusualwhales.com

🚨BREAKING🚨

— unusual_whales (@unusual_whales) January 2, 2024

I have just released the full report on politicians trading in 2023.

Like every year since 2020, US politicians beat the market.

And many in Congress made unusually timed trades resulting in huge gains.

Here are the top performers of 2023. pic.twitter.com/ykf9VICsBw

And the Winner is…

You can find more at this portfolios page (account needed but basic is free). Follow the politicians’ money making money, easily.

*The SPDR S&P 500 ETF Trust is one of the most popular funds. It aims to track the Standard & Poor’s (S&P) 500 Index, which comprises 500 large-cap U.S. stocks. These stocks are selected by a committee based on market size, liquidity, and industry. The S&P 500 serves as one of the main benchmarks of the U.S. equity market and indicates the financial health and stability of the economy. Also known as the SPY ETF, the fund was established in Jan. 1993