If you are 65 or older (or turn 65 any time in 2019), you will have the option to use a new simple tax form for seniors, known as the 1040SR, when you file your 2019 taxes in April 2020. The new form is provided for in section 41106 of the Bipartisan Budget Act of 2018 (BBA), a two-year budget agreement passed by Congress and signed by President Donald Trump on Feb. 9, 2018.

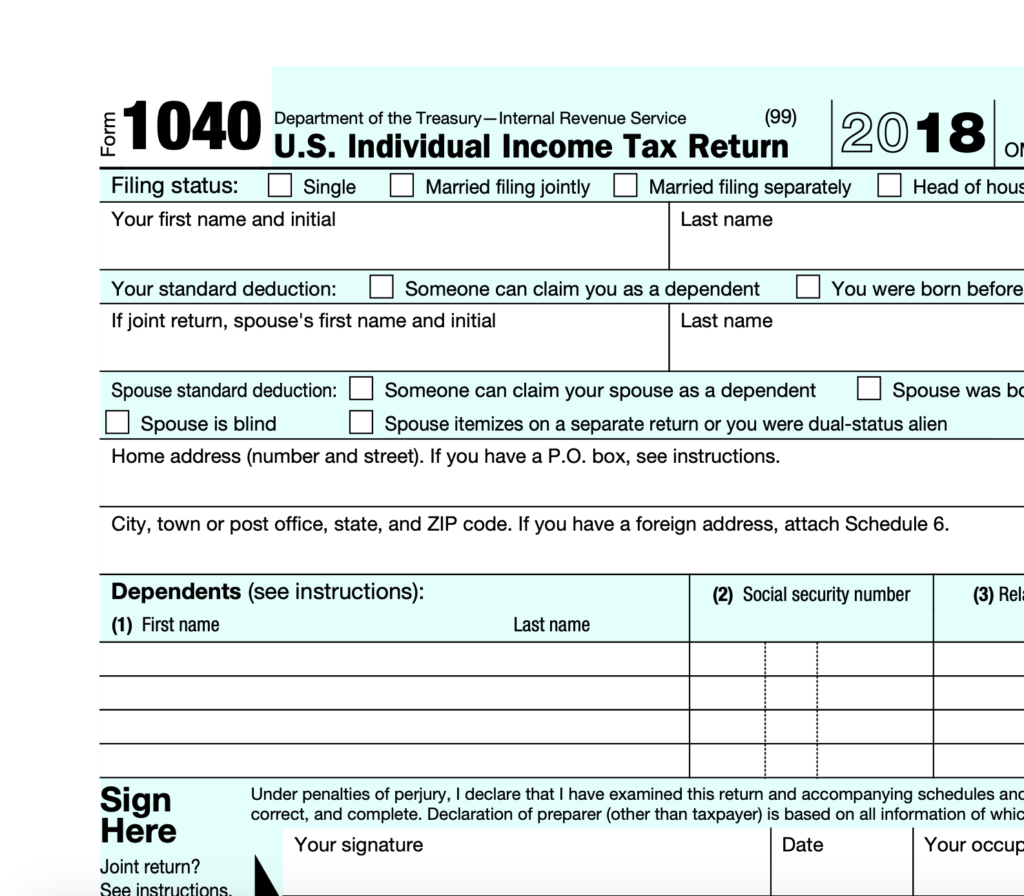

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

For Tax Year 2018, you will no longer use Form 1040-A or Form 1040-EZ, but instead will use the redesigned Form 1040. Many people will only need to file Form 1040 and no schedules.

However, if your return is more complicated (for example you claim certain deductions or credits, or owe additional taxes) you will need to complete one or more of the new Form 1040 Schedules. Below is a general guide to what Schedule(s) you will need to file, based on your circumstances. See the instructions for the Schedules for more information.

Individuals who filed their federal tax return electronically last year may not notice any changes, as the tax return preparation software will automatically use their answers to the tax questions to complete the Form 1040 and any needed schedules.

Get your form here: https://www.irs.gov/pub/irs-pdf/f1040.pdf

New Simple Tax Form for Seniors Is Similar to Form 1040EZ

Form 1040SR will be designed to be “as similar as practicable” to Form 1040EZ and will serve as a simplified tax form for seniors with uncomplicated finances. While Form 1040EZ only allows you to report income from wages, salaries, and tips, Form 1040SR will allow income from certain other sources, as well. Additional differences between 1040EZ and 1040SR are described below, including age requirements and total income allowed.

65 and Older

One major difference between 1040EZ and 1040SR has to do with your age. Form 1040EZ is available to any taxpayer under the age of 65 who otherwise meets income and filing requirements. To use 1040SR you must be 65 or older by Dec. 31, 2019, or by the end of the tax year for which you will be filing. For example, if you turn 65 on Dec. 31, 2019, you can use 1040SR when you file your 2019 taxes in April 2020. If you are 65 any time in 2020, you can use 1040SR to file your 2020 taxes in 2021. Being retired isn’t necessary. If you are still working at age 65 and otherwise qualify to file 1040SR, you may do so. On the other hand, early retirees (younger than 65) cannot use 1040SR.

More at https://www.investopedia.com/taxes/seniors-get-new-simplified-tax-form/, https://nstp.org/blog/seniors-get-a-new-simplified-tax-form-for-2019 and https://www.irs.gov/forms-pubs/about-form-1040

Pingback: does hydroxychloroquine affect kidneys

Pingback: where to buy hydroxychloroquine and azithromycin